Dark Order Dex: A New Market Shape Arrives On Acki Nacki

Crypto has lived in the open too long. Every move, every order, every hint of intent hanging in the mempool like a neon sign that predatory bots read…

Crypto has lived in the open too long. Every move, every order, every hint of intent hanging in the mempool like a neon sign that predatory bots read…

SummaryThe Web3 Voice AMA with Mitja Goroshevsky offers a rare, unfiltered look into the technical foundations, roadmap, mentality, and philosophy behind Acki Nacki. What begins as a casual…

Acki Nacki has officially surpassed 1,000,000 smart contracts deployed on-chain, an unprecedented feat for any blockchain within its first month of launch. 🎉 According to verifiable public data,…

Acki Nacki is stepping into fashion, launching Acki Nacki CryptoWear, the first blockchain-born fashion line that fuses digital creativity with real-world design. To mark this bold move, the…

There’s a growing buzz around the Acki Nacki universe, and now the community is opening its doors wider than ever. The team behind the lightning-fast, power-efficient blockchain has…

USDC is now live on the Acki Nacki mainnet, contracts deployed, balances visible in the Wallet, and tournament prizes already paid to winners in USDC. Next up: in-wallet…

As Acki Nacki Explorers roll out, it’s tempting to believe you can crack the code behind your Popit mining rewards. A few quick comparisons, a bit of number…

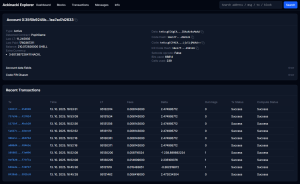

Acki Nacki blockchain has allready (less then week since chain launch) expanded its ecosystem with two powerful dApps that make transparency, verifiability, and usability central pillars of its…

Mitja dropped a X post (tweet), well, few of then and they read like a detonator. No roadmaps, no promises, no keys held by owners/founders, just code that…

Acki Nacki announced it will launch its public blockchain on Monday, September 23 at 17:00 Central European Time. The company listed corresponding times as 11:00 EDT in New…

IntroBlock by Block sits down with Mitja Goroshevsky, the engineer’s engineer, to talk what actually makes a chain feel instant, not just look fast on slides. We trace…