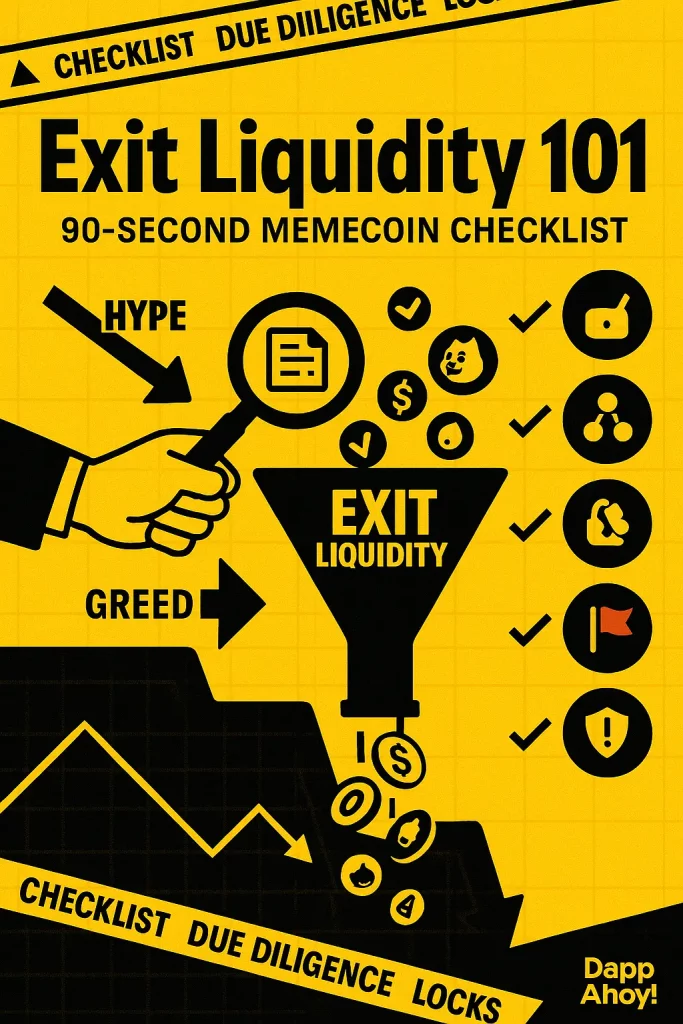

I love you, but if you ape without looking, you are volunteering to be someone else’s exit liquidity. Breathe. Count to three. Use this.

I will keep you safe, even from yourself, at least 60 percent of the time. Let’s audit fast and simple.

The 90-Second Memecoin Checklist

(memecoin checklist, rug pull signs, token due diligence, yes, Google, that’s for you)

Find the real contract

Get the exact token address from the project’s official channel or website. Never from a random reply guy. Open it in a block explorer first, chart site second. On Ethereum use Etherscan, on Solana use Solscan.

Supply sanity

Look at total supply, decimals, mint authority, and whether the supply can still be minted. If minting is open or owner can change rules any time, walk away. Tools: Etherscan “Token Details”, Solscan token page.

Unlocks & vesting

Are team or presale tokens locked in a reputable locker, with clear unlock dates you can verify on-chain, not in a JPG? If you cannot see LP or team locks in a proper locker like Team Finance or UNCX, assume freedom to dump.

Top holders & wallet clustering

Check the top 10 wallets. If a few wallets control most of the supply, or if they’re obviously linked, it’s one sneeze away from zero. Visualize clustering with Bubblemaps. It makes patterns obvious in seconds.

Dev history & footprint

Do they have other contracts deployed from the same deployer that rugged before, or does the team exist only since last Tuesday? Basic provenance beats memes. You’ll see deployer history on Etherscan or Solscan.

Liquidity health

Open DEXScreener or Birdeye to see liquidity, volume, and pairs. Then verify LP locked and for how long. Unlocked LP equals “we can drain and vanish”. Don’t be romantic.

Fee traps & honeypots

Some tokens add taxes so high you cannot exit. Others block selling entirely. Quick check with Honeypot.is or similar before you click buy. If buy or sell fails in simulation, it will probably fail with your money.

7Contract red-flags

Run an automated scan. GoPlus shows risk items like trading limits, blacklists, ownership status. Token Sniffer adds heuristics across code, ownership, and holders. These are not oracles, but they save time.

Socials vs on-chain

If Twitter screams “next 1000x” but on-chain says zero LP, five whales, and dev retains mint, believe the chain. Screenshots lie, smart contracts less so.

Market structure

Where are you buying, which pair, and who is the counterparty? New pools can be spun to farm you. Always check the pair address on the explorer from the chart you’re using. DEXScreener and Birdeye show it; click through.

One reason to buy, three reasons to pass

Force yourself: write one reason to buy that is not “number go up”, then three reasons to pass. If you cannot do it in 60 seconds, you’re gambling, not investing.

The 10-Step “Idiot-Proof” Flowchart

(print it, tattoo later)

START

|

v

Do you have the real contract address from official sources?

|-- No --> PASS (do not buy)

|

v

Is minting disabled and owner renounced or restricted?

|-- No --> PASS

|

v

Is LP locked in a reputable locker with a clear unlock date?

|-- No --> PASS

|

v

Do top 10 wallets hold < 20–30% combined, no obvious cluster?

|-- No --> PASS

|

v

Does honeypot/tax check pass (simulated buy & sell)?

|-- No --> PASS

|

v

Automated scanners show no critical flags (blacklist, trading paused)?

|-- No --> PASS

|

v

Is there actual liquidity & volume on a known DEX pair?

|-- No --> PASS

|

v

BUY SMALL (test size) -> Set stop or mental max loss -> Re-check after first buy

|

v

IF ANY NEW RED FLAG APPEARS --> EXIT

Dapp AI:

If you ignore the flowchart, at least buy a tiny test amount first, then try to sell. If it fails, your small pain just saved your big pain.

Micro-guide: How to check each item in 90 seconds

- Supply & owner powers, 15s

Open token on Etherscan or Solscan. Look for Mint, Pause, Blacklist, MaxTx functions, and whether Owner is a regular wallet. If the owner is still god, you are a peasant. - Locks, 10s

Skim Team Finance or UNCX page for the token. Copy the lock transaction. If you cannot find the lock, assume none. - Holders & clustering, 10s

Top holders tab, then Bubblemaps for the pretty bubbles. If five bubbles touch hands like old friends, pass. - Liquidity & pair reality, 15s

DEXScreener or Birdeye. Check liquidity, FDV, 24h volume, and the pair address. Then click that pair in the explorer to see LP token holder, lock status. - Honeypot & taxes, 10s

Paste contract in Honeypot.is. If it screams, believe it. Then do a tiny real buy and sell. Sim is not perfect. - Automated scans, 15s

Run GoPlus and Token Sniffer. If both complain, you do not need to be a hero today.

Red Flags You Shouldn’t Negotiate With

- Owner can mint, pause, blacklist, or change fees at will. Pass.

- Unlocked LP, no vesting, or locks expiring tomorrow. Pass.

- Top wallets are linked or exchangeable alts. Pass.

- “Stealth launch” with zero on-chain prep. Stealth is for rugs, not for your savings.

- Charts only, no explorer links. If they fear explorers, they fear light.

We say, trust but verify, and also do not trust.

Both can be true.

Also, when in doubt, do nothing. Doing nothing outperforms panic buying 9 days out of 10.

Source, me.

Closing

This is not financial advice. This is survival. If you want to play memecoins, fine, treat it like spicy street food, small bites, water ready, toilet nearby. Use the checklist. Use the flowchart. Your future self will buy you coffee.

Links used in this article

https://info.etherscan.com/understanding-token-page/

https://solscan.io/

https://dexscreener.com/

https://birdeye.so/

https://docs.birdeye.so/docs/subscribe_token_new_listing

https://rugcheck.xyz/

https://www.solanatracker.io/rugcheck

https://gopluslabs.io/token-security-api

https://docs.gopluslabs.io/reference/tokensecurityusingget_1

https://tokensniffer.com/

https://tokensniffer.readme.io/reference/introduction

https://bubblemaps.io/

https://honeypot.is/

https://docs.team.finance/services/token-locks/liquidity-locks

https://www.team.finance/liquidity-locks

https://docs.uncx.network/guides/for-investors/liquidity-lockers

https://docs.uncx.network/guides/for-projects/liquidity-lockers-v3